What Are Automated Trading System?

Automated trading systems (also called algorithmic trading and black-box trading) are computers that make use of mathematical algorithms to make trades based on specific requirements. These platforms have been developed to automate the execution of trades without the need of human intervention.

Trading rules- Automated trading systems are programed with specific rules for trading and conditions that decide when it is appropriate to enter and exit trades.

Data input - Automated trading Systems process huge amounts of market data real-time and utilize this information to make trading decisions.

Execution- Automated trade execution systems can execute trades at speeds, with frequency and in a manner that is impossible for an individual trader.

Risk management - Automated trade systems are able to be programmed to ensure that they implement strategies for managing risk, such as stop-loss orders and size of positions to limit potential losses.

Backtesting: Prior to being employed in live trading, software for automated trading can be tested back.

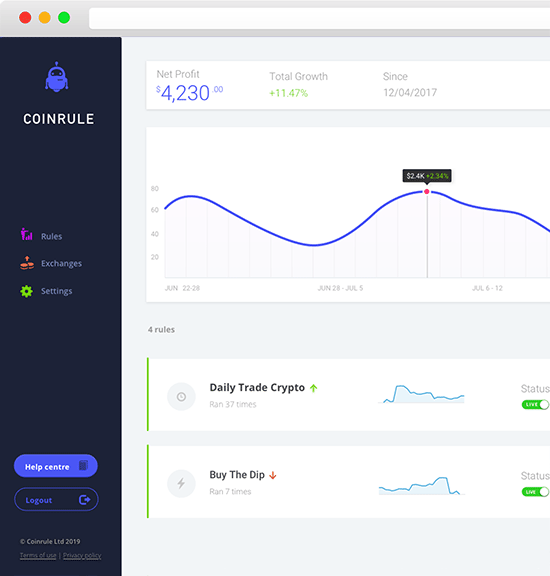

The greatest benefit of automated trading systems is their capability to perform trades fast, accurately and without the necessity of human intervention. Automated trading platforms are able to handle large quantities of data in real time and create trades based upon certain rules and conditions. This will reduce the emotional impact of trading and increase the consistency.

However, there are also certain risks using automated trading systems such as the possibility of system failure, errors in the trading rules, as well as an absence of transparency in the process of trading. It is therefore important to test and validate the automated trading platform prior to it is implemented in live trading. View the recommended cryptocurrency automated trading for blog info including cryptocurrency backtesting platform, crypto trading backtester, algo trading strategies, position sizing in trading, forex backtester, stop loss crypto, stop loss and take profit, best free crypto trading bot 2023, forex backtester, stop loss meaning and more.

What Are The Ways That Automated Trading Systems Function?

Automated trading systems process large quantities of market data in real time and make trades according to specific rules and regulations. It is possible to break down the procedure into the steps below. Set out your trading strategy. This first step involves defining your trading strategy. This may include indicators such as moving averages, as well as other factors such price action or news events.

Backtesting- Once the trading strategy has been established you can test it back by using data from the past market to determine whether there are any problems. This is vital as it gives traders to look back at how the strategy has worked in the past prior to deciding whether they should apply it to live trading.

Coding - After the trading strategy has been backtested and confirmed The next step in the procedure is to write the strategy into an automatic trading system. This involves converting the strategy's rules and terms to a programming language, such as Python or MQL (MetaTrader License).

Data input - Trading platforms that are automated require real-time market data to help make trading decisions. The data is typically acquired from a vendor of data.

Trade execution - After the market data is processed, and all conditions to trade are fulfilled, the automated trade system will perform the trade. This includes sending trade instructions to the broker, who will then place the trade on the market.

Monitoring and reporting- The majority of automated trading systems come with built-in monitoring and reporting tools that permit analysts and traders to monitor and spot issues, as well as monitor system performance. This includes real-time performance as well as alerts in case of unusual market activity.

The process of automated trading can occur in milliseconds. This is more efficient than the human trader would take the information and create an offer. This speed and precision can lead to more efficient and consistent trading outcomes. To ensure that the system is functioning correctly and is fulfilling your trading objectives However, it is crucial to validate and test the system prior to implement it in live trading. View the top forex tester for blog recommendations including best forex trading platform, backtesting trading, rsi divergence, auto crypto trading bot, trading platform cryptocurrency, automated trading, trading platform cryptocurrency, backtester, crypto backtesting, forex backtester and more.

What Happened In The Flash Crash Of 2010? Flash Crash

The Flash Crash 2010, a sudden and severe stock-market crash, occurred on May 6 in 2010. The flash crash that occurred on the 6th of May in 2010, was described as a serious and sudden stock market crash. These factors included-

HFT (high-frequency trades)HFT (high-frequency trading) HFT algorithms used sophisticated mathematical models as well as market data to create trades. These algorithms are responsible for large volumes of trading that contributed to market instability, and increased selling pressure during the flash crashes.

Order cancellations- HFT algorithms were developed to cancel orders if the market moved in an unfavorable direction, which caused additional selling pressure during the flash crash.

Liquidity The flash crash was caused by a lack liquidity in the market. Market makers and other players retreated briefly from the market in the crash.

Market structure- With multiple exchanges and dark pools The U.S. Stock market was extremely complex and fragmented. This made it difficult for regulators to monitor the market and respond to it in real time.

The flash crash had significant impact on the financial markets, resulting in significant losses for individual investors and market participants, and decreased confidence in the security of the stock market. Following the flash crash regulators implemented several measures to improve the stability of the stock market, including circuit breakers which temporarily suspend trading on individual stocks in times of high volatility. They also increased the transparency of markets. Check out the top stop loss crypto for blog info including algo trading, crypto trading, cryptocurrency backtesting platform, crypto backtesting platform, backtesting strategies, stop loss meaning, algo trade, emotional trading, crypto trading bot, trading platform cryptocurrency and more.

Comments on “Recommended Hints For Deciding On Automated Software”